Unlocking the Potential of Container Homes in Boca Raton

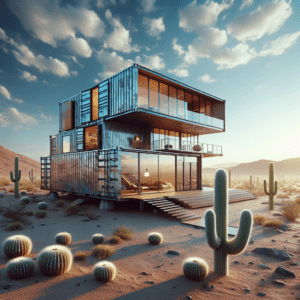

Imagine a home that breaks the mold, a space where design meets sustainability, and where affordability doesn’t mean compromising on style. This is the world of container homes, and it’s a trend that’s taking Boca Raton by storm. Container homes are not just a housing option; they’re a lifestyle choice that reflects a commitment to innovation and environmental responsibility. Let’s explore how you can make this dream a reality.

My Favorite Container Homes Resource

I compared the top 3 Container Home Guides

to discover the ultimate resource!

See my top recommendation here

Key Takeaways

- Container homes are a unique blend of design, sustainability, and affordability.

- Financing options for container homes include traditional mortgages, personal loans, and specialized loans.

- Understanding the specifics of container home financing in Boca Raton is crucial for a smooth process.

- Insurance for container homes is essential and requires a tailored approach.

- Grants and incentives can make container homes even more accessible and affordable.

What Container Homes Offer to Prospective Owners

Container homes offer a fresh take on living spaces. They are adaptable, often more affordable than traditional homes, and can be designed to fit any lifestyle. The benefits of choosing a container home in Boca Raton are plentiful:

- Eco-Friendly: Reusing shipping containers reduces waste and the carbon footprint associated with building a new home.

- Customizable: These homes can be tailored to your exact specifications, allowing for a personalized living experience.

- Durability: Built to withstand harsh conditions at sea, container homes are structurally sound and can endure extreme weather.

- Speed of Construction: Container homes can be built faster than traditional houses, meaning you can move in sooner.

- Cost-Effective: With the right planning, container homes can be significantly less expensive than conventional homes.

Choosing a container home is about making a statement — it’s about embracing a future where your home reflects your values and your vision.

Comprehensive Financing Strategies for Your Container Home

So, you’re captivated by the idea of a container home, but how do you finance it? Fear not, as there are several paths you can take to secure the funds needed to bring your container home to life. Each option comes with its own set of benefits, and understanding these will help you make the best choice for your situation.

Navigating Traditional Mortgage Options

Traditional mortgages are a common route for home financing, but they come with specific requirements when it’s about container homes. Here’s what you need to know:

- Foundation Requirements: Your container home must be anchored to a permanent foundation to qualify for a mortgage.

- Appraisal Considerations: Lenders will require an appraisal to ensure the home’s value is in line with the loan amount.

- Building Codes: Compliance with local building codes and zoning regulations is mandatory to secure financing.

It’s essential to work with lenders who understand the unique nature of container homes and are willing to navigate the process with you. With the right lender, a traditional mortgage can be a solid foundation for your container home journey.

Stay tuned as we continue to guide you through the ins and outs of financing your container home in Boca Raton, ensuring you’re equipped with the knowledge to make your dream home a reality.

Personal Loans as a Versatile Solution

When traditional mortgages don’t quite fit, personal loans can step in to fill the gap. They’re a flexible option that can cover not just the cost of the container but also the customization that turns it into your dream home. Here’s why personal loans might be the right choice for you:

- Flexibility: Personal loans often have fewer restrictions on how the money can be used.

- Speed: The approval process for personal loans can be quicker than for mortgages.

- Collateral-Free: Many personal loans are unsecured, meaning you don’t need to put your new home up as collateral.

Remember, while personal loans are versatile, they typically come with higher interest rates. It’s important to shop around for the best rates and terms that fit your budget.

Specialized Container Home Lenders: Tailored Financing

There’s a growing community of lenders who get what container homes are all about. These specialized lenders offer financing that’s designed for the unique aspects of container living. They understand the value and potential of these homes, and they’re ready to work with you. Here’s what sets them apart:

- Expertise: They know the ins and outs of container home construction and valuation.

- Customized Loans: Their loan products are tailored to meet the specific needs of container home buyers.

- Supportive Process: They often provide guidance throughout the home-building journey.

Engaging with a lender who specializes in container homes can lead to a smoother and more informed financing experience.

Exploring Government-backed Loans for Sustainability

Government-backed loans can be a win-win for you and the planet. These loans often come with favorable terms and support the construction of sustainable homes. Here’s how they can help:

- FHA Loans: The Federal Housing Administration backs loans that may allow lower down payments and credit scores.

- VA Loans: If you’re a veteran, VA loans can offer competitive rates and terms for container homes.

- USDA Loans: For homes in rural areas, USDA loans might provide financing with no down payment.

Government-backed loans encourage the construction of eco-friendly homes, making them a great option for container home financing.

Creative Financing Alternatives: Crowdfunding and Beyond

Thinking outside the box can lead to creative financing solutions. Crowdfunding platforms allow friends, family, and even strangers to contribute to your container home project. It’s a way to engage your community and share your vision. Other creative options include:

- Home Equity: If you already own property, you might be able to use home equity to finance your container home.

- Partnerships: Teaming up with a local business or non-profit can lead to unique funding opportunities.

- Bartering: Offer your skills or services in exchange for materials or labor for your home.

While these methods require more effort and coordination, they can also bring your community together and make your container home a collective achievement.

Insurance Essentials for Container Homes in Boca Raton

Just like any home, your container home in Boca Raton needs to be protected. Insurance for container homes is a must, but it’s not quite the same as a standard homeowner’s policy. You’ll need to find an insurance provider that understands the unique aspects of your home. Here’s what to consider:

- Value Assessment: Ensure your insurance provider knows how to accurately assess the value of a container home.

- Coverage Specifics: Look for a policy that covers the specific risks associated with container homes, like their ability to withstand severe weather.

- Liability Protection: As with any home, liability coverage is crucial to protect yourself in case someone is injured on your property.

Securing the right insurance means you can enjoy your innovative home with peace of mind, knowing you’re covered for the unexpected.

Customized Homeowner’s Insurance Plans

When it comes to insuring your container home, one size does not fit all. You’ll want to partner with an insurer who can tailor a policy to fit the unique characteristics of your container home. This means coverage that takes into account the innovative construction methods, materials used, and the potential for modifications and expansions. Here’s how to get started:

- Discuss with insurers the specifics of your container home, including its design and materials.

- Ask about adding riders or endorsements to your policy for custom elements or valuable additions.

- Ensure that your policy includes replacement cost coverage to fully protect your investment.

- Consider additional living expenses coverage in case your home is uninhabitable after a covered loss.

- Look for insurers that offer discounts for security features or sustainable building practices.

Finding a customized insurance plan means you can rest easy, knowing that your unique home is protected just as well as any traditional house would be.

Finding the Right Coverage for Unique Container Structures

Container homes are special, and finding the right insurance coverage requires attention to detail. You’ll need to ensure that your policy covers the distinctive aspects of your home, from its ability to withstand high winds to its modular nature. Here’s what to focus on:

- Verify that your policy covers the actual container, including any custom modifications.

- Check if your insurer provides coverage for “green” upgrades or sustainable materials used in your home.

- Understand the claims process for container homes, which may differ from traditional structures.

- Ensure that your policy covers theft or damage during the construction phase if you’re building from scratch.

By finding the right coverage, you’re not just insuring a structure; you’re protecting a lifestyle and a future that you’re passionately building.

Grants and Fiscal Incentives for Eco-Friendly Homes

Going green with your container home isn’t just good for the environment; it can be great for your wallet too. There are a variety of grants and fiscal incentives available that reward eco-friendly building practices. These can significantly offset the costs of your container home project. Let’s dive into how you can take advantage of these opportunities.

Maximizing Federal Grants for Green Living

The federal government often provides grants and tax incentives for homeowners who choose sustainable living options. These can range from tax credits for energy-efficient appliances to grants for using renewable energy sources. Here’s how to make the most of these opportunities:

- Research federal energy tax credits available for energy-efficient home improvements.

- Look into the Database of State Incentives for Renewables & Efficiency (DSIRE) for up-to-date info on federal incentives.

- Consider applying for renewable energy system grants if you plan on using solar panels or other green technologies.

- Keep detailed records of all your eco-friendly upgrades and expenditures for tax time.

By tapping into these federal grants, you’re not just building a home; you’re investing in a sustainable future and getting rewarded for it.

State and Local Programs Benefiting Boca Raton Residents

- Investigate Florida’s Property Assessed Clean Energy (PACE) program for financing energy-efficient upgrades.

- Explore local utility rebates for installing energy-efficient systems and appliances.

- Check with the City of Boca Raton for any local incentives or grants for sustainable development.

- Stay connected with local green building councils or environmental groups for updates on new incentives.

State and local programs can be a game-changer for your container home project, offering financial support and resources that make green living a no-brainer.

Private Grants and Awards for Sustainable Development

It’s not just the government that sees the value in sustainable living. Private organizations are also stepping up, offering grants and awards to those who push the boundaries of eco-friendly design and construction. These can be a boon for your container home project, offering recognition and financial support for your innovative choices. Here’s how to tap into these resources:

- Research foundations and non-profits that support sustainable housing initiatives.

- Prepare a compelling story about your container home project to share in grant applications.

- Network with other container home owners and builders to learn about lesser-known grant opportunities.

- Keep an eye out for contests and awards that recognize innovative sustainable housing projects.

- Be prepared to showcase the environmental benefits of your container home, such as reduced material waste and energy efficiency.

Private grants and awards can provide not just financial assistance, but also a platform to inspire others to consider sustainable living solutions.

Final Considerations in Securing Your Container Home Investment

As we wrap up our guide to financing, insuring, and securing grants for your container home in Boca Raton, there are a few final considerations to keep in mind. These will ensure that your investment is sound and that your journey to container home ownership is as smooth as possible.

The Importance of Compliance and Due Diligence

Before you dive into building your container home, it’s critical to ensure that you’re in compliance with all local zoning laws and building codes. Due diligence in the early stages will save you from headaches and costly changes down the line. Here’s what you need to focus on:

- Check with Boca Raton’s zoning department for any restrictions on container homes in your desired location.

- Ensure that your building plans meet all local building codes and safety standards.

- Work with experienced contractors who understand the specifics of container home construction.

- Consider hiring a lawyer to help navigate the legal aspects of

.

Compliance and due diligence are the cornerstones of a successful container home project. They protect your investment and ensure that your dream home becomes a reality without legal obstacles.

Maintaining Financial Health During Your Home-Building Journey

Building a home is an exciting adventure, but it’s important to keep your finances healthy throughout the process. Budgeting, planning for unexpected expenses, and keeping your credit in good standing will help you maintain financial stability. Here’s how to stay on track:

- Create a detailed budget that includes all aspects of your container home project.

- Set aside a contingency fund for unforeseen costs that may arise during construction.

- Continue to pay all your bills on time to keep your credit score strong.

- Avoid taking on new debt while your container home is being built.

- Keep communication open with your lenders and insurers throughout the building process.

By managing your money wisely, you can enjoy the process of creating your container home without financial stress overshadowing the experience.

Frequently Asked Questions

As we explore the exciting world of container homes, questions naturally arise. Here are some of the most common queries we encounter, along with clear, concise answers to help you on your journey.

What Makes Container Homes a Financially Wise Choice?

- Cost-effectiveness: Container homes can be more affordable than traditional construction.

- Eco-friendly: Potential savings on energy costs due to the sustainable nature of container homes.

- Speed of construction: Faster build times can lead to reduced labor costs.

- Customization: The ability to control costs through DIY projects or choosing specific modifications.

Container homes offer a unique blend of affordability and sustainability, making them a financially savvy option for many homeowners.

Can I Use a Regular Mortgage to Finance a Container Home?

Yes, it is possible to use a traditional mortgage to finance a container home. However, the home must meet certain criteria, such as being affixed to a permanent foundation and complying with local building codes. It’s important to work with a lender who is familiar with container homes to navigate the process.

What Are the Unique Insurance Challenges of Container Homes?

- Valuation: Determining the replacement cost can be more complex than for traditional homes.

- Construction phase: Finding coverage for the home during the building or modification phase.

- Custom features: Ensuring that unique elements of the home are fully covered.

- Understanding: Working with an insurer who understands the unique nature of container homes.

Securing the right insurance for a container home means addressing these challenges head-on with a knowledgeable provider.

How Can I Find Out About Grants Available for My Container Home?

Research is key when looking for grants. Start by checking federal and state databases for renewable energy and sustainable housing incentives. Networking with local green building communities and non-profits can also uncover grant opportunities that may not be widely advertised.

Are There Eco-Friendly Incentives Specific to Boca Raton?

Boca Raton and the broader Florida region offer several incentives for eco-friendly construction. The PACE program is one example, and local utilities may provide rebates for energy-efficient installations. Keep an eye on local government announcements and work with local green building councils for the latest information.

What Makes Container Homes a Financially Wise Choice?

Choosing a container home is not just about making an architectural statement—it’s a smart financial decision too. Here’s why:

- Lower Initial Costs: Shipping containers themselves are relatively inexpensive. The savings on the raw structure can be substantial compared to traditional building materials.

- Reduced Construction Time: A shorter build time means less spent on labor, and you can move in faster, saving on rent elsewhere.

- Energy Efficiency: With proper

and design, container homes can keep energy costs down, thanks to their compact size and ability to retain temperature. - Less Maintenance: The durability of steel containers translates into lower maintenance costs over time.

- Increased Flexibility: Container homes can be easily expanded or modified, which can be more cost-effective than renovating traditional homes.

Financial wisdom comes from seeing the big picture, and with container homes, the savings stack up from the ground up.

Can I Use a Regular Mortgage to Finance a Container Home?

Absolutely, you can use a regular mortgage to finance a container home. However, the key is to ensure that your container home meets the same requirements as a traditional house. This includes having a permanent foundation and being compliant with all relevant building codes and regulations. It’s also important to work with a lender who understands and values the unique nature of container homes. Clear communication and proper documentation will help smooth the way for your mortgage approval.

What Are the Unique Insurance Challenges of Container Homes?

Insuring a container home does come with its own set of challenges, but don’t let that deter you. Here’s what to watch out for:

- Understanding Value: Insurance companies may not be familiar with the true value of a container home. You may need to educate them on the cost of replacement and the value of modifications.

- Construction Phase Coverage: Finding an insurer that will cover the home during the construction or modification phase can be tricky, but it’s essential.

- Custom Features: Unique elements of container homes, like green roofs or fold-out walls, might require additional coverage.

- Code Compliance: Insurers will want proof that your home complies with local building codes, which can affect your coverage options.

Partner with an insurance provider who’s willing to understand the specifics of your container home to ensure you’re fully covered.

How Can I Find Out About Grants Available for My Container Home?

Grants can be a fantastic way to offset the costs of your container home, and they’re worth the effort to find. Start by:

- Visiting local government websites for information on housing grants and incentives.

- Checking out the Database of State Incentives for Renewables & Efficiency (DSIRE) for up-to-date listings.

- Reaching out to local environmental organizations—they often have the scoop on eco-friendly grants.

- Attending home and garden shows or sustainable living expos where grant information is often shared.

With some digging and networking, you can uncover grants that can make your container home even more affordable.

Are There Eco-Friendly Incentives Specific to Boca Raton?

Boca Raton is a forward-thinking community that supports sustainable living. As a resident, you may have access to:

- Local rebates for installing solar panels or other renewable energy sources.

- Programs like PACE, which can help finance energy efficiency improvements with no upfront costs.

- Utility company incentives for energy-saving appliances and fixtures.

- Community initiatives that support green building practices and technologies.

Stay informed about local developments in sustainability to take full advantage of these incentives.

In wrapping up, remember that financing, insuring, and finding grants for your container home in Boca Raton is a journey—one that requires research, patience, and a bit of creativity. But the rewards are clear: a home that reflects your values, saves you money, and treads lightly on the earth. Whether you’re drawn to container homes for their financial benefits, their eco-friendliness, or their unique aesthetic, you now have the tools and knowledge to make your vision a reality.

So go ahead, dream big, and build small. Your container home awaits, and with the strategies outlined in this guide, you’re ready to take the next step towards sustainable living in Boca Raton.

Remember, the future of housing is not set in stone—it’s being crafted from steel, vision, and the desire to do things differently. Embrace the container home movement, and be part of a community that’s redefining what it means to call a place ‘home.’